Nurphoto / Getty Images

- Bitcoin could surge to $168,000 as the launch of a futures ETF drives a new equilibrium in supply and demand, according to Fundstrat.

- Fundstrat expects daily demand for bitcoin to rise by $50 million per day due to the new ETF.

- With a daily block reward of $10 million in bitcoin, demand will be three times higher than supply, according to Fundstrat.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Bitcoin could surge to $168,000 as the launch of a bitcoin futures ETF on Tuesday drives a surge in demand for the cryptocurrency among a wider swath of investors, Fundstrat said in a Monday note.

With bitcoin trading just 4% below its record high on Tuesday, a surge to $168,000 would represent potential upside of 170%. Fundstrat noted that the price target exceeds even its bullish year-end price target of $100,000 for the cryptocurrency.

"The price of bitcoin will continue to rise, well after actual approval of the ETF," Fundstrat said.

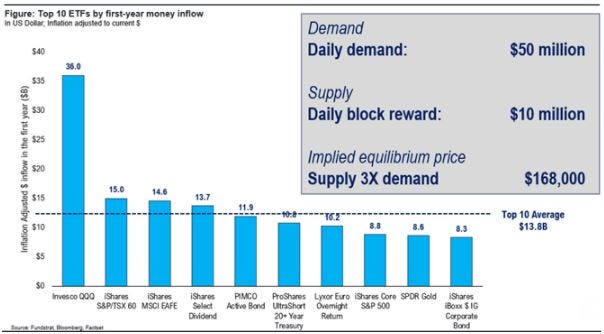

Fundstrat expects the Proshares Bitcoin Futures ETF to see record inflows in its first year of trading, exceeding even the launch of the Invesco QQQ Trust in 1999, which brought in $36 billion. Fundstrat believes the Bitcoin $BITO ETF could see first yar inflows exceeding $50 billion, according to the note.

That's because the bitcoin ETF will allow more investors to gain exposure to bitcoin via their brokerage and retirement accounts, where a large sum of money already sits. All-in, the launch of the new bitcoin futures ETF could drive $50 million per day in daily demand for bitcoin, according to Fundstrat.

With bitcoin block rewards at $10 million per day, the equilibrium between the supply and demand of bitcoin will not be balanced unless the price of bitcoin moves significantly higher.

"The equilibrium price to clear this, based on analysis by our data science team, is $168,000," Fundstrat said.

With cryptocurrencies currently only about 1% of liquid assets, that number should rise as more investors are able allocate to the bitcoin futures ETF in more traditional investment accounts.

"This will drive higher asset prices via network effects," Fundstrat concluded.